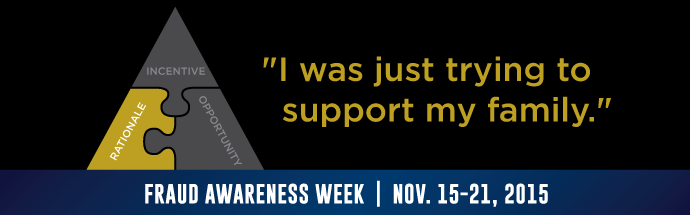

Rationalizing Fraud: “I was just trying to support my family.”

We recently received a call from a small business owner who had just discovered that a long time employee had been stealing from his business. The crafty scheme involved fictitious vendors and false invoices that resulted in checks being written to accounts belonging to the employee and his girlfriend. The thief (or thieves, as it turned out) was a trusted employee, of course, but rationalized taking the money so he could “support his family.” That is, support the family with luxury items, vacations, gadgets, and goodies.

This kind of fraud is distressingly common, despite that it is so hard to understand in the context of mature, cooperative behavior. We are simply programmed to learn to trust people that we share experiences and challenges with over a long period of time. We form teams.

The Rationale Does Not Have to be Rational

Donald Cressey’s well-known “Fraud Triangle” identifies three elements needed to trigger a fraud: opportunity, motivation or pressure, or rationalization. It’s the rationalization that most often strikes us as removed from reality in some way, or transparently false. We feel a shock when someone trusted betrays us, and our first reaction is that they must feel the same way—how could they do this?

But that’s the point of rationalization. The person who betrays you does not see the situation the same way you do; it’s not about a shared vision or understanding. He or she has invented a story that makes it seem fair or legitimate to steal or cheat. The justification is what allows the fraudster to keep the fraud going over a long period of time, which is one of the markers of many organizational frauds.

If the rationalization is successful, the fraudster will not feel guilt or remorse. In fact, he or she may rationalize themselves as the victim! There are as many rationalizations as there are fraudsters, but you are familiar with some of their stories: They didn’t get the promotion that went to someone less able and less experienced. They are not paid what they are worth. The organization exploits its workers. Everyone takes a little on the side to make up for the company’s “stingy” pay policies, etc. etc….

A Rationalization is a Secret

The opportunity and motivation sides of the fraud triangle are a little more objective than rationalization. We have a decent chance to observe the circumstances that might lead someone to commit a fraud, such as weak internal financial controls (opportunity) or knowing that an employee is having intense money problems (motivation). We can improve our knowledge of opportunity through better auditing procedures, and we can learn more about our employee by regular internal reviews.

But rationalization is a psychological state that’s very difficult to see. Further, it can be very common—we all rationalize from time to time. Professor Pamela Murphy has studied this mental component of fraud and concluded that many of us—maybe most of us—are capable of rationalizing fraud under the right circumstances.

Just as a fraud is committed in secrecy, so the “reason” for it is kept secret. Sharing it with others would risk exposing the perceptions underlying the rationalization and make it impossible to keep them. By the same token, the rationalization side of fraud is very difficult to detect and prevent.

The Roots of Rationalization

Organizations have more straightforward ways to detect and prevent fraud based on opportunity and motivation factors, but there are some things that may help to deflect the perceptions that might lead to fraud. In general, what might be the circumstances that breed rationalizations for fraud?

There is no perfect answer here because there will always be people who justify fraud under any conditions. But if the organization does permit hiring, firing, promoting, and rewarding through personal connections (it’s who you know), or exploits workers, or allows other actions that an objective person might consider unfair, then the soil is prepared for fraud rationalization.

A healthy organizational culture is an important tool in preventing fraud. It will not necessarily allow you to know which frauds were prevented, but you will be less likely to be shocked by a betrayal.

ABOUT THE AUTHOR