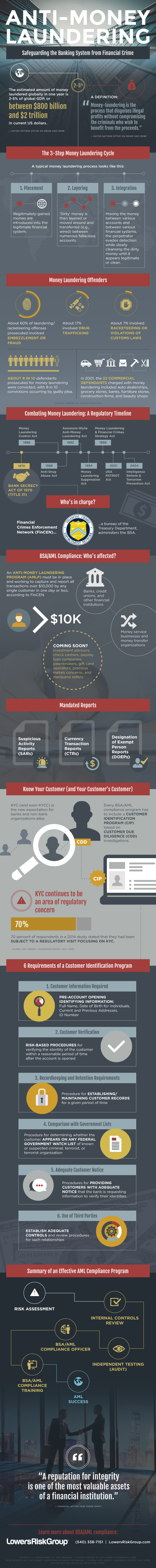

Anti-Money Laundering: An Overview [Infographic]

Firms must comply with the Bank Secrecy Act and its implementing regulations (“AML rules”). – Financial Industry Regulatory Authority

The Bank Secrecy Act (BSA) and all the related laws that have been passed since the BSA began in 1970, aim to harden targets within the financial system against money laundering schemes. AML rules accomplish this by requiring covered institutions to implement an Anti-Money Laundering Plan (AMLP)—essentially putting surveillance into the hands of the financial institutions in the fight against money laundering.

Your AMLP must comply with the guidelines in the rules, providing authority and controls, generating a set of mandatory reports, exercising customer due diligence, and maintaining an information trail. Even though each financial institution is permitted to develop the plan consistent with its own risk-adjusted profile, The AMLP is a serious undertaking.

Our Infographic on Anti-Money Laundering provides a checklist of the background and components of an AMLP. Although the final plan will be greatly more detailed, the infographic organizes what has to be done in context so why it has to be done is easily understood.

Check out the full infographic here:

ABOUT THE AUTHOR